Concentrated Investors in High-Quality Companies at Attractive Prices

We define quality companies as those that exhibit financial strength and are managed by able and honest management teams whose interests are aligned with those of its shareholders.

Benefits of Concentration

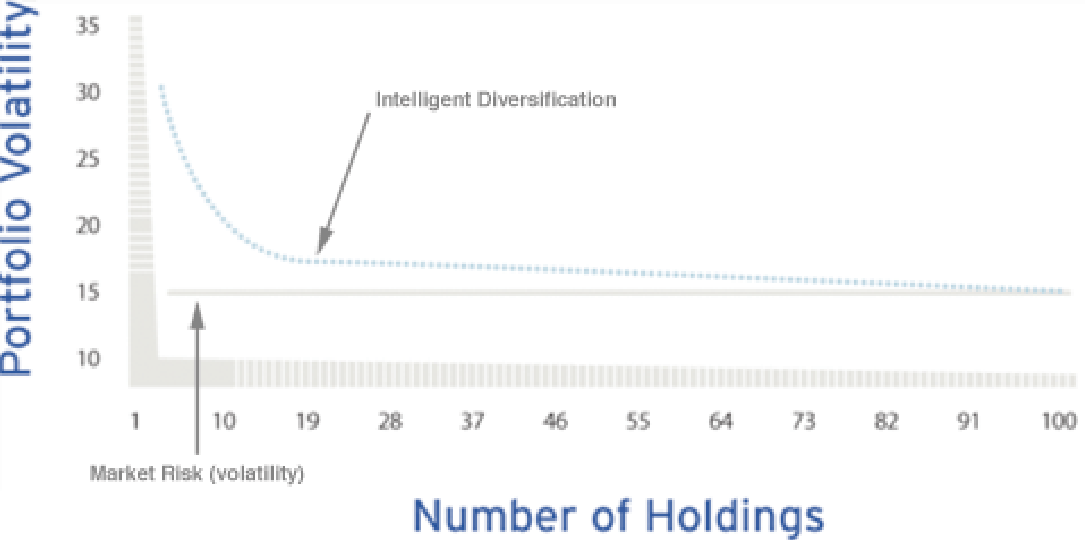

Portfolio diversification is essential to reducing risk, but only up to a point. As the chart below illustrates, portfolio volatility is significantly reduced when holding a concentrated portfolio of approximately 20 stocks diversified across multiple industries. We believe adding substantially more companies increases risk because it dilutes the benefits of allocating capital to our best ideas.

Footnotes

James Montier, Value Investing: Tools and Techniques for Intelligent Investment (London: Wiley Press, 2009), 42