Benefits of Concentration

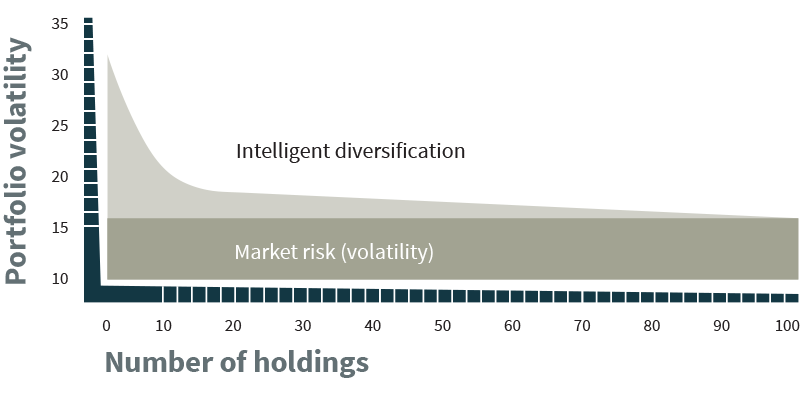

Portfolio diversification is essential to reducing risk, but only to a point. As the chart below illustrates, portfolio volatility is significantly reduced when holding a concentrated portfolio of approximately 20 stocks diversified across multiple industries. We believe adding substantially more companies can increase risk while diminishing performance, as it dilutes our collective knowledge and reduces the impact of our best and most reasoned ideas.

Adapted from James Montier, Value Investing: Tools and Techniques for Intelligent Investment (London: Wiley Press, 2009), 42